Frequently Asked Questions:

What does the NRRA Finance Department do for you, our Member?

- Record weights, and assure accuracy with quoted pricing.

- Compare the BOL and scale tickets to ensure consistency.

- Work with vendors and members to correct discrepancies.

- Answer questions regarding invoices and checks that you receive.

Incase you did not know:

- NRRA's payment and invoicing schedule occurs every two weeks

- NRRA's fiscal year is from October 1st to September 30th

- We offer both paper checks and direct deposit payments. You can request to have your checks mailed or have payments made electronically via ACH/Direct Deposit.

Why is your completed Bill of Lading (BOL) so important?

The finance department receives all of your BOL's. We attach them electronically to your order. When we enter the weight of your load, we compare that to your completed BOL and make sure that what you sent (the type, weight, quantity, etc.) are all consistent. We will refer to your completed BOL if there is a question or discrepancy, so having these on file is extremely important to assist us in resolving potential issues. It is also proof that the load happened. We encourage you to send over a BOL for each order as soon as possible after the load has been picked up or delivered.

- email, upload using the button below or fax: (603) 736-4402.

Your own copy and NRRA's copy does not need to be a hard copy - save it as a PDF or take a picture using your phone to further reduce paper waste.

What is a fuel surcharge?

A fuel surcharge is an extra fee that many vendors that haul commodities charge to cover the fluctuating cost of fuel. It's usually calculated as a percentage of a base rate and is added to the hauling charge.

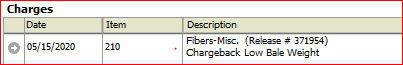

I saw a comment on my invoice that said "chargeback" - What is that?

A "chargeback" (sometimes called a "dead weight deduction") is a charge for a load that does not meet the vendor's minimum weight requirement. Vendors will sometimes charge for the "dead" or empty space on the truck as the price of transportation is most often based on a full truckload.

What is the difference between Net and Non-Net?

NRRA offers two accounting options for members. You can choose "net accounting" or "non-net accounting". If you do not specify a choice, you will automatically fall under the net accounting option. However, you may change to non-net at any time by sending us a request in writing to do so (email request). The option you choose will likely depend on the type of budgeting you have in your community. Some towns have enterprise funds to cover their costs, while others must budget specifically for expenses and revenues may go into the general fund. NRRA offers these two options as a way to better accommodate your specific situation.

- Net Accounting - Revenues and expenses would be "netted" out so you would receive a single check or invoice for each accounting run, and it will include all payments and charges that are ready to process at that time.

- Non-Net Accounting - All charges would be issued on an invoice and all payments would be issued on a check.

Example of each option:

You scheduled a load of OCC. The vendor comes to pick up the load and charges $112 for the haul. The revenue from the OCC is $200. A net town would receive a check in the amount of $88 ($200 revenue less $ 112 for haul). A non-net town would receive a check for $200 for the revenue and would also receive an invoice for $112 for the haul.

Does NRRA send out monthly statements?

We do not send out monthly statements. Checks and invoices are sent out on a pretty strict schedule every two weeks. Our goal is to invoice and pay relatively quickly, and typically that falls between 30-45 days from the date of pick up or delivery. We have found that statements can cause confusion and often result in duplicate payments, so for that reason (as well as conserving resources) we do not send them.

Electronic Invoices

Reduce paper waste and avoid tearing open yet another piece of mail.

Who should I contact?

If you have questions or concerns about payments or invoices, please email: accounting@nrrarecycles.org (monitored daily) or give us a call at 603-736-4401. We are happy to help you.